Buying a new home as a first-time homebuyer is an exciting chapter in anyone’s life, whether you’re buying on your own or buying your first home together as a newly married couple. But it can also be a challenging experience, from understanding all the steps that come with it to the competition you might face when making offers on houses. So, to get you off on the right foot, we have a few tips we think will be useful insights for first-time homebuyers (and maybe a handy refresher for the pros).

Understanding the full scope of the costs of buying a house

The first big tip we can offer may be an obvious one, but it’s still important—start saving as soon as you can. This should come as no surprise, but purchasing a home is usually the single largest purchase you’ll make in your lifetime. But don’t let that intimidate you–all it means is the sooner you can start saving for a down payment, the better!

While some people are wealthy enough to do an all-cash offer, most can’t afford to buy a house in one singular purchase. It’s much more common (and usually more financially savvy) to finance a home purchase and take out a mortgage loan, which is usually comprised of several parts. The most common aspects to understand are:

Your down payment

Down payments are the amount of money you pay to secure the amount you’re borrowing for your home loan. The more money you are able to pay upfront, the smaller your monthly mortgage payments will be. Why? Let’s say the house you want to buy costs $300,000. If you were to buy a house without a down payment, you’d be asking the bank to lend you the full amount, which would mean a higher monthly payment of about $1,839 (after insurance, taxes, etc.) and more interest payments over the life of the loan. When you pay a down payment, you’re actually asking the bank to lend less than $300,000, because you’ve already paid part of the home’s price up front.

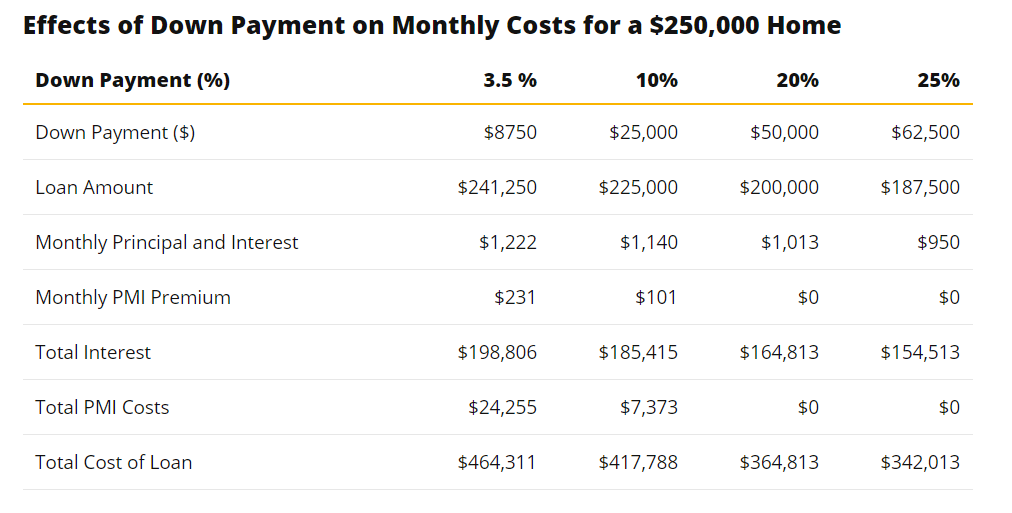

However, you can’t not pay a down payment (unless you’re buying in all cash, you lucky devil). Banks will require you to put at least a 3% down payment to qualify for their loans. With a 3% down payment in our situation ($9,000), your monthly payments drop to closer to $1,797. A 10% down payment ($30,000) drops it to about $1,699, and so on. Check out this chart from ValuePenguin with a few more variations:

Private mortgage insurance (PMI) if you’re doing a down payment of less than 20%

Lenders will often encourage you to do a 20% down payment if you can afford it because it dramatically reduces your monthly payments. And even if you can’t afford a 20% down payment, the more you can afford, the more quickly you’ll get to stop paying insurance on your loan. ValuePenguin sums it up nicely:

“A bigger down payment on a conventional loan will also speed up the process of reaching 80% on your loan-to-value (LTV) ratio, which is the percentage of how much you still owe on your mortgage. You can stop paying mortgage insurance once the cash you’ve paid towards your home, including the down payment, reaches 20% of your home’s value, or 80% LTV — which reduces your monthly payments. However, you should keep in mind that FHA loans require you to pay insurance for the life of the loan.”

That insurance we just mentioned, the one you want to stop paying ASAP, is called private mortgage insurance (PMI). PMI is a special kind of insurance your lender will have you take out if you opt to pay less than a 20% down payment. Their logic is that if you can’t afford to pay more money upfront, you may not have a very high income, which could make you a little more risky to loan to in their eyes—so they want to protect themselves in the event you ever struggle to make your monthly payments.

PMI is an additional monthly charge on top of your principal (the actual amount you took a loan out for) and interest and usually costs between 0.5% and 1% of the mortgage annually. Thankfully, as with any loan, you can always make higher monthly payments than your minimum requirement. So, if you find yourself in a better financial spot than when you first bought your house, you can make bigger payments each month to stop paying PMI faster.

Closing costs

Closing costs are the assortment of fees you pay for the costs and services to finalize your mortgage. Most of the time, closing costs fall on you, the buyer, but the seller does also have to pay a few of these costs (like paying the real estate agent’s commission). You can also sometimes negotiate closing costs with the seller, depending on the circumstances under which you’re buying the house (the state of the market, condition of the house, move out terms, etc.).

On average, mortgage closing costs run from 2% to 5% of the loan cost (including property taxes, PMI, etc.). One such cost is your home inspection, a crucial part of buying a house. It’s usually conducted after your offer has been accepted on a house, but it’s not unheard of for buyers to pay an inspector to come with them to a showing to gain early insight on the condition of the home they’re considering. While it’s easy to say that an inspector will look at “everything”, it’s not a bad idea to understand just what “everything” means, and what questions might be good to have ready for them. Some other typical items included in your closing costs are:

- Appraisal fee

- Title fees

- Application fee

- Mortgage insurance (PMI)

NerdWallet has a great closing costs calculator that can help you understand these and other closing cost fees and how much you can expect to pay.

Your monthly mortgage payment

This is the easy(ish) one! This is how much you’re going to be paying every month for your mortgage. As we mentioned, the largest part of your monthly payment is your principal and interest amount—the amount of money you borrowed combined with the interest rate your lender is charging you. The rest of your monthly payment is usually comprised of:

- Your property taxes. Property taxes vary by what state, county, and/or city you live in. It’s the amount your local government is charging you to own your property, and those taxes go back into the system to constantly improve your hometown.

- Your homeowners insurance. While homeowners insurance isn’t technically required by law, you’re putting yourself at huge risk without it. It covers damage to your property and all your belongings inside, so without the right insurance, you could be on the hook for a lot of money!

- Your PMI. We already went over this one, scroll back up if you forgot!

- Any Homeowners Association (HOA) Fees if you’re living in a neighborhood that has an HOA

NerdWallet also has a great mortgage calculator that factors in all these costs (minus move-in expenses) to calculate what you can expect your average monthly payment to be for everything.

Move-in expenses

Move-in expenses seem far down on the list of things to worry about, but they’re still important! Consider what budget you have for things like:

- Buying boxes, tape, and other packaging supplies.

- Renting or buying equipment to make your move easier, like dollies and hand trucks.

- Whether you pay for movers to help you (if you can afford it, we highly recommend this)

- Moving on the weekends is the most popular time to do so, which means that a lot of movers will charge higher rates for moving on weekend days. If you have paid time off available to you, consider moving on a weekday to save money.

- Fuel costs if you’re moving far away from your current home

Find peace of mind as a first-time homebuyer with homeowners insurance

We know that buying your first home can be both exciting and daunting, so we hope this little guide can help you through those more stressful parts. And to avoid any undue stress, make sure you protect your cozy new home with the right homeowners insurance for you from Elephant.

Article last updated on June 25th, 2023 at 7:31 pm