Affordable Maryland car insurance

Maryland drivers can look to Elephant for affordable and reliable car insurance protection. Learn more about Maryland car insurance requirements and ways to save.

Get a Maryland car insurance quoteMaryland drivers save 12% when you quote online!

If you’re researching car insurance in Maryland, you’ve come to the right place. Starting your Elephant Insurance quote online will earn you a healthy discount right away. We know choosing coverage can be tricky, but it doesn’t have to be. The Elephant Quote Wizard makes finding the protection you need easy, and a licensed agent is available should you want to talk through your policy. Learn more about Maryland car insurance requirements while saving money on your car insurance policy.

Car insurance coverage requirements in Maryland

Maryland drivers are required to have a minimum 30/60/15 liability limits on their car insurance coverage. Liability coverage is a third-party coverage, meaning that the payout is for the other party involved in the accident, not the insured. The minimum limits required in Maryland are:

$30,000

limit for bodily injury liability coverage per person

$60,000

limit for bodily injury liability coverage per accident

$15,000

limit for property damage liability coverage per accident

Maryland law also requires uninsured and underinsured motorist coverage. Uninsured motorist (UM) and underinsured motorist (UIM) are first-party coverages, meaning that the payout is for the insured drivers on the policy, not the third party. This additional insurance protects you against uninsured drivers and those who have insurance but not enough to cover damages. The minimum limits required in Maryland are:

- $30,000 limit for bodily injury liability coverage per person

- $60,000 limit for bodily injury liability coverage per accident

- $15,000 limit for property damage liability coverage per accident

The state of Maryland also requires insurers to offer policyholders at least $2,500 in MedPay and PIP coverage. You may be able to waive PIP coverage for certain individuals resulting in a reduction in premium.

Additional auto insurance coverage options available in Maryland

You can take advantage of the car insurance coverage options available from Elephant Insurance, including:

Comprehensive and collision insurance protects your car

Comprehensive and collision insurance helps pay to repair or replace your car if it is damaged, regardless of who is at fault. You select a deductible that you pay out of pocket and your insurance company pays for the remaining damage up to the limits you select. Comprehensive coverage can help cover the value of your vehicle if it’s stolen as well as cover expenses resulting from damage from a weather event such as hail. Collision insurance coverage helps pay to repair or replace your car if it’s damaged in by colliding with another vehicle or object, such as a sign or fence.

PIP or personal injury protection

Full PIP and guest PIP are two types of personal injury protection (PIP) coverage in Maryland. PIP is a type of insurance that may provide reimbursement for your medical expenses, lost wages, substitute services, and funeral expenses if you are injured in a car accident, regardless of who is at fault.

Full PIP: If purchased, Full PIP provides coverage for all insured drivers and household members over the age of 16 who are in the vehicle at the time of an accident. You may waive this coverage when you purchase your policy if you feel you don’t need it.

Guest PIP: Guest PIP is a type of PIP coverage that covers passengers in your car. It doesn’t cover you or your household members over the age of 16. Guest PIP is optional, but it’s a good idea to have it if you often have passengers in your car.

If you choose to waive full PIP coverage in Maryland, you can still choose to have guest PIP. This means your insurance company may cover passengers in your car, but it will not cover you or your household members over the age of 16.

Uninsured/underinsured motorist

When the person at fault for an accident does not have car insurance, uninsured motorist coverage can cover damages, medical treatment, and lost wages. If your injury expenses exceed the at-fault party’s liability limits, you can use underinsured motorist bodily injury coverage to help pay for the amount not covered by the at-fault person’s insurance.

Enhanced underinsured motorists (“EUIM”) is an optional coverage in Maryland. EUIM is similar to underinsured motorists coverage, but the limit is not reduced by the amount of available coverage by the at-fault driver’s insurer. Chat with an agent about whether EUIM coverage is right for you.

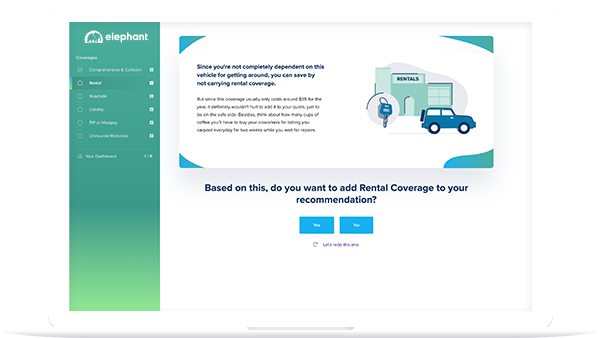

Rental reimbursement

Rental reimbursement helps pay for your rental car if your car isn’t driveable for 24 hours or more because of a loss covered by your comprehensive or collision coverage.

Roadside assistance

Roadside assistance coverage saves you from being stranded on the side of the road when something goes wrong with your car. If purchased, roadside assistance is available for use when your car is disabled due to a covered emergency, such as:

- Mechanical or electrical breakdown

- Battery failure

- Insufficient supply of fuel, oil, water, etc.

- Flat tire

- Lock-out

- Entrapment in snow, mud, water, or sand

Personalize your policy to expand your protection

In addition to the coverages offered above, Elephant offers additional options to personalize your Maryland auto insurance. A few of these include the following:

Upgraded accident forgiveness

Accident forgiveness is a policy feature that’s automatically earned after a customer goes 3 consecutive years without having an accident on their policy. Instead of waiting more than 3 years for an accident waiver, customers can now purchase upgraded accident forgiveness that’ll start immediately once your policy starts.

Legal coverage

For as little as $5/month, you can have peace of mind that your legal needs will be handled by specialized attorneys for many of the complicated situations that life can throw at you, including contesting a moving violation or creating a will. Find more information at Legal Resources Plan.

Diminishing deductible

Diminishing deductible, sometimes called a “disappearing” or a “vanishing” deductible, this coverage feature can be added onto a vehicle’s collision deductible to lower the out-of-pocket costs in the event of an accident.

Factors that impact your auto insurance premiums In Maryland

Your car insurance rate is dependent on many variables. Here are a few factors that help determine your insurance rate:

The type of car you drive

The type of vehicle you drive can impact your insurance rate. Cars that are older, smaller, have a lower safety rating, are more expensive to repair, or are considered luxury vehicles often require higher premiums. Learn more about how your vehicle impacts your rates.

Your driving record

Frequent accidents, tickets, and insurance claims alert the insurance company that you are a high-risk driver, and your rate will likely be higher than a driver with a clean record.

Vehicle usage

How you use your car can impact your rate. For example, if you have a long commute or use your vehicle for business, you will likely pay higher rates than if you don’t drive very often.

Your credit score

An article in 2022 reported that in Maryland, a driver with no credit may have a 41% higher premium on average than a driver with excellent credit. Credit scores may be used as an additional factor in setting car insurance premiums.

General rate trends

Maryland auto insurance rates may trend up or down. The premium you pay will depend on these overall rate trends.

Maryland car insurance discounts

Elephant offers a number of car insurance discounts to help you save money on your Maryland car insurance. Whether you are working from home, or you have a good student on your car insurance policy, or you have multiple cars to insure, we have a discount for you. Get a Maryland car insurance quote online to find your discounts.

State discounts

We have many car insurance discounts Maryland drivers can discover including:

You can also save 12% just by starting your Maryland auto insurance quote online!

Save on Maryland car insurance when you bundle

Combine homeowners or renters insurance with your auto policy to keep money in your pocket with our multi-policy discount.

Car insurance information by major cities in Maryland:

Maryland car insurance and driving laws

Insurance companies in Maryland are required by law to provide fair, reasonable rates to all eligible drivers. There are some laws that impact qualifying for insurance and your rates.

FR-19

The Maryland Motor Vehicle Administration may require an FR-19 to verify current or past insurance coverage on a vehicle. This form verifies that a vehicle has been continuously insured and that coverage on the vehicle is current. If requested, drivers may need to obtain a verification form from their insurance company.

SR-22

An SR-22 can be required in some states when a driver has been convicted of a driving-related charge. Maryland is a non-SR-22 Insurance state. However, it may apply to drivers who move to another state. The Maryland MVA has more information available.

Distracted driving laws in Maryland

One in seven crashes involves driver distraction according to the National Highway Traffic Safety Administration. In Maryland, the law prohibits all motorists from writing, sending, or reading a text message while operating a vehicle in the traveled portion of a roadway. A texting violation could result in fines, points on a driving record, or license suspension. Visit Maryland’s government page for more information and read more about cell phones and safe driving.

Maryland teen driving laws

Learning to drive comes with a lot of responsibility, and there are restrictions in place for drivers under the age of 18. Check with your insurance company before your teen obtains a permit to learn more about adding them to your policy and check your state’s government pages for more information on teen driving laws.

Out-of-state violations

Most states share out-of-state violations with the driver’s home state. Once your insurance company is notified, they will determine whether the violation will impact your premium.

Maryland car insurance FAQs

Here are a few commonly asked questions about car insurance in Maryland:

What car insurance coverage is right for me?

+

Like most things, car insurance coverage in Maryland is best determined by the individual. We try when you have the right tools, you can feel confident in the policies you’ve selected. For more guidance, look at our Coverage Wizard or read more in-depth about the car insurance coverages Elephant offers. When you’re familiar with each of the coverage types and your state’s minimum requirements, you’re well on your way to finding the coverage that works best for you.

When and how can I change my Maryland car insurance policy?

+

You can make changes to your Maryland car insurance any time during the life of the policy. Making changes to your policy should be easy and can be done by calling your insurance carrier or by logging into your account if you have online access.

What if I need to get my car repaired after an accident in Maryland?

+

If you need to get your car repaired after an accident in Maryland, you have a few options:

File a claim with your insurance company: If you have comprehensive and collision coverage on the damaged vehicle, your insurance company can help pay for the repairs to your car.

File a claim with the other driver’s insurance company: If the other driver was at fault for the accident, you can file a claim with their insurance company. You will need to provide them with proof of the accident, such as a police report and an estimate from a body shop. If the other driver’s insurance company agrees that they are at fault, they may pay for the repairs to your car.

Pay for the repairs yourself: If you do not have comprehensive and collision, or if the other driver’s insurance company does not agree to pay for the repairs, you will need to pay for the repairs yourself. You can take your car to any body shop you choose, but you may want to get estimates from several shops before you decide.

What are the things that affect car insurance rates in Maryland?

+

Car insurance rates in Maryland can be affected by a number of factors, including:

Age: Younger drivers are generally considered to be riskier than older drivers, so they tend to pay higher rates.

Driving history: A clean driving record is one of the best ways to get lower car insurance rates. However, even a single at-fault accident can cause your rates to increase.

Vehicle type: The make and model of your car can also affect your rates. Cars that are more expensive to repair or that are more likely to be stolen typically have higher rates.

Annual mileage: Drivers who drive more miles per year are more likely to get into an accident, so they typically pay higher rates.

Location: The city or town where you live can also affect your rates. Cities with higher rates of accidents or theft typically have higher rates.

To find out what coverage you need, check out our Coverage Wizard.

What are Maryland’s minimum auto insurance requirements?

+

Maryland car insurance laws require drivers to have a minimum 30/60/15 liability limits on their car insurance coverage. Liability auto insurance is a type of car insurance that helps protect you financially if you are found at fault in an accident. It can help cover the cost of injuries to other people and damage to their property. Liability coverage is a third-party coverage, meaning that the payout is for the other party involved in the accident, not the insured.

Maryland minimum car insurance liability limits required are:

$30,000 limit for bodily injury liability coverage per person

$60,000 limit for bodily injury liability coverage per accident

$15,000 limit for property damage liability coverage per accident

In addition, Maryland law requires the following minimum amount of uninsured motorist coverage:

$30,000 limit for bodily injury liability coverage per person

$60,000 limit for bodily injury liability coverage per accident

$15,000 limit for property damage liability coverage per accident

Maryland law requires insurers to offer policyholders at least $2,500 in personal injury protection (PIP) coverage. You may be able to waive PIP coverage for certain individuals resulting in a reduction in premium.

What liability insurance is required in Maryland?

+

Liability insurance helps protect you financially if you are found at fault in an accident. Liability coverage helps pay to repair the other driver’s car if you caused the accident. It can also help pay the other driver’s and his or her passenger’s medical bills and some other expenses. Maryland law requires you to have at least $30,000 of coverage for injuries per person, up to a total of $60,000 per accident, and $15,000 of coverage for property damage. This is called 30/60/15 coverage

What is a “30/60/15” minimum auto policy?

+

A 30/60/15 minimum auto insurance policy describes minimum liability limits Maryland requires drivers to carry. Liability insurance helps protect you financially if you are found at fault in an accident. It can help cover the cost of injuries to other people and damage to their property. Policy limits are the maximum amounts that an insurance company can pay out under each type of coverage. Maryland law requires you to have a minimum $30,000 of liability coverage for injuries per person, $60,000 per accident, and $15,000 of liability coverage for property damage. Maryland also requires uninsured and underinsured motorist coverage minimums of $30,000 for injuries per person, $60,000 per accident, and $15,000 for property damage.

What is considered “full coverage” car insurance in Maryland?

+

When people talk about full coverage auto insurance, they’re usually referring to a car insurance policy that is a collection of coverages to protect the policy holder in various situations. It’s not an actual type of insurance and the term can vary in meaning. Typically, full coverage is liability (usually includes bodily injury and property damage) plus comprehensive and collision coverage. When you finance or lease your vehicle, your lender or leasing company may require you carry comprehensive and collision coverage. To find out what coverage you need, check out our Coverage Wizard.

Do you need car insurance to register a car in Maryland?

+

Yes, you need proof of insurance when you register a car in Maryland. In Maryland, you are required to carry a minimum of $30,000 of liability coverage for injuries per person, $60,000 per accident, and $15,000 of liability coverage for property damage.

You can register a car without insurance, but you will only be able to get a “title only” registration. This means that you will not be able to drive the car on public roads.

The documents you may need to register a car in Maryland include:

- Proof of insurance

- Proof of ownership (such as the title or registration from your previous state)

- Proof of vehicle inspection

- Completed application for Maryland title and/or registration

- Registration fee

You can find more information about registering a car in Maryland at Maryland.gov.

Do I need uninsured motorist coverage in Maryland?

+

Being involved in a car accident is bad enough, but it can be much worse if the driver who caused the accident doesn’t have insurance or doesn’t have enough insurance. Uninsured motorist coverage can help in this situation.

Maryland drivers must have a minimum of $30,000 in Maryland uninsured motorist bodily injury coverage per person (up to $60,000 per accident), as well as $15,000 in uninsured motorist property damage insurance per accident.

Why choose Elephant for your car insurance in Maryland?

Elephant offers straightforward auto insurance solutions that save you hard-earned money and make it easy to connect with us. We provide tools and services for Maryland drivers to make it easy to find and use the best auto insurance protection around.

Auto insurance at a fair price

Find the car insurance coverage you need to protect you and your car, discounts to save money, and add-on services like real-time roadside assistance to make life easier.

Tools to make car insurance simple

Manage your policy and file claims quickly and easily with our mobile app, claims photo app, online account access, and agent chat.

Learn more about our policy perks

Flexible car insurance options

Flexible payment options and online tools. With flexible payment plans, multiple purchase options, convenient insurance claims filing and our highly reviewed mobile app, Elephant delivers protection with convenience.

Bundle insurance for more savings

For your convenience and extra savings, we partner with multiple providers to offer home, renters, condo, motorcycle, off-road vehicle, and umbrella insurance. Bundling offers Maryland drivers another way to save.

Learn more about bundling your policies

Our customers give us high marks and we hope you will too.

We are proud that 9 out of 10 customers renew with us each term* and that our average Google rating is 4.7 stars as of 9/2023.

And we’re very proud to have been named a Forbes America’s Best Insurance Company 2023. Forbes partnered with Statista to survey over 15,000 U.S. customers of more than 3,300 U.S. insurance companies to create the rankings. Participants rated their insurance providers in terms of their overall satisfaction and whether they would recommend them to family and friends.

Superior car insurance claims experience

In 2022, Elephant has earned a customer confidence score (Net Promoter Score) that is 32% higher than the industry average. Our claims team and repair network are there when you need them.

Start a claimLogin to track a claimClaims FAQs

*89% of customers stayed with Elephant at renewal in 2022.

Get the peace of mind you need with Virginia car insurance from Elephant

Try our Coverage Wizard an online tool to make sure you have the right coverage for your Virginia car insurance or alternatively go straight to our car insurance online quote.

Try our Coverage Wizard

Retrieve your Maryland car insurance quote

If you have visited Elephant earlier and started or completed a car insurance quote for a policy Maryland, you can easily pick up where you left off by retrieving your quote now.

Recent posts about Car-insurance

Feel confident in your car insurance coverage

Give us a call for car insurance in Maryland

Want to speak to someone? No problem. Call us at

1-855-ELEPHANT