- Home

- »

- Blog

- »

- Homeowners

- »

- 4 ways a new home affects your homeowners insurance rates

On the list of major purchases, it doesn’t get much bigger than buying a new house. While there’s a certain charm to getting a place that’s been lived in, there’s also something special about being a home’s initial tenants.

There are a number of differences between an existing home and a new home. Most of them are pretty obvious, like custom features that allow owners to hide unsightly cords for electronic hookups, for instance, or more modern plumbing and heating. It’s these same features that also play a role in how homeowners insurance rates are established for new homeowners.

Why are older homes more expensive to insure than newer homes?

Similar to auto insurance, there are multiple factors that influence how premiums are set, but chief among these is your home’s age. The general rule is the older the home, the more you’ll pay for your homeowners insurance. According to The Zebra,

“The price difference in insuring a new construction versus a 10-year-old house is 45%. Rates climb incrementally as the home ages through the decades.”

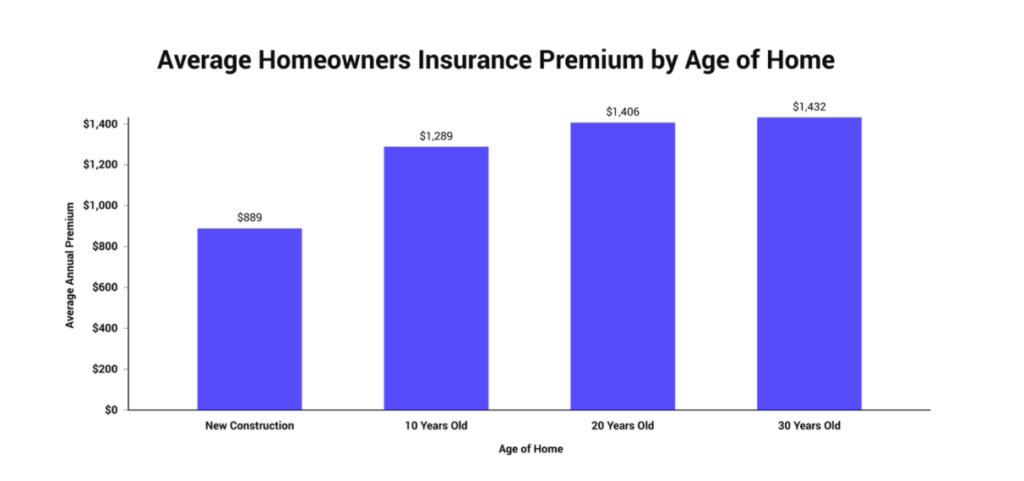

The Zebra also put together this nifty little chart based on research they conducted on the average prices of premiums based on house age.

If you’re the owner of a new residence — one that’s been built within the last few years — you’ll be able to take advantage of lower rates in most cases. But why does the age of your home cause home insurance prices to rise so dramatically? Let’s take a closer look.

Older homes encounter structural problems more often

Much of this stems from the very nature of age. The older homes are, the more likely they are to encounter problems, or have outdated structural issues that are more likely to be on their last legs. For example, water pipes may burst under high stress (like freezing temperatures), or roofs may damage due to wear and tear, or even foundations can have problems if building codes have been changed.

Repairing or replacing your older house is more difficult

While it’s hard to replicate the charm and character of certain features of an older house, those features could end up costing you more to fix. Home building materials are constantly improving and evolving, which means that the older your house is, the harder it will be to find the same materials to replace aspects of your house should they be damaged.

Other factors that determine the cost of homeowners insurance

Location, location, location

The location of your new residence also factors into how much you’ll spend for homeowners insurance. The cost of building supplies varies around the country, as does exposure to natural disasters like hurricanes in the Northeast or tornadoes in the Midwest. Because newer homes are more capable of withstanding the forces of nature, this plays a role in premium pricing as well. You may be able to lower your homeowners insurance costs by renovating or installing features that reinforce the structural integrity of your residence, like storm shutters for your windows, for example.

Renovation plans

A 2019 Trulia survey indicated that 90 percent of homeowners planned to remodel their homes at some point, up from 84 percent in 2018. They also found that the most popular rooms to remodel are kitchens and bathrooms, both of which deal with plumbing and electricity, which for older homes can mean larger expenses to update older structures and systems. It’s important to keep your insurance provider in the loop on these additions, as these too can affect your rates and may leave you underinsured if you don’t properly account for them. While it might hurt to see your insurance premium rise at first, knowing that these expensive changes are covered will save you thousands in the long run.

New installations cost more to replace

Homeowners insurance covers you if the structure of your residence is damaged, but it also protects your belongings and interior features. Generally speaking, new homes tend to have more expensive installations, like marble countertops or hardwood flooring. Because these can be costly to replace, it can affect what you spend in homeowners insurance.

What insurance should I get for my older or newer home?

Let’s borrow from our Homeowners Insurance Guide to answer this one.

There are technically eight types of homeowners insurance. However, because some types of insurance are highly specialized—or even obsolete—it’s important to know which type meets your needs. Rather than review all eight, let’s take a look at the most popular option.

HO-3 insurance policies are considered the most standard and almost every insurance company offers them. These policies cover the physical structure of your home on an open-perils basis, meaning that any loss that’s covered is not explicitly excluded from your policy. Rather than name every peril covered, HO-3 includes all exclusions, including earthquakes, war, nuclear accidents, landslides, and mudslides. Generally, HO-3 is a viable option for most types of homebuyers. In fact, of the approximate 85% of homeowners who have home insurance, 78% of those are HO-3 policies.

And HO-3 policy should effectively cover almost any home, regardless of age. If your house has any specialty or particularly unusual features, chat with your insurance provider to see what other options might be best for you.

I’m buying an older home—how can I save on my insurance costs?

Often times, lowering your insurance premiums can come in the form of taking steps to safeguard your older house, like installing a new roof, reinforced windows, or updating your electrical grounding system.

Another easy, guaranteed way to get a lower cost on your insurance premium is by bundling your homeowners insurance with your auto or other insurance policies. Elephant’s Multi-Policy Discount can sometimes end up saving our customers hundreds of dollars!

These are just a handful of the factors you should take into consideration after buying your new place, no matter how old it is. For more help in determining the appropriate amount of insurance for you, your family, and what will likely be your biggest investment, be sure to check out our homeowners insurance page.

Article last updated on June 25th, 2023 at 7:30 pm