Frequently Asked Questions

Insurance is complicated and can be overwhelming, but there’s a lot of information worth knowing. We’ve pulled together some basics to help you get started.

Car Insurance Basics

Why do I need car insurance?

Two big reasons: 1) it is typically required by law, and 2) it protects you and your financial assets in the event of a costly accident. Insurance is a funny product – you buy it, but hope to never have to use it. However, it can be one of the best investments you ever make, and it’s only when you need it that you realize how valuable it is. That’s why it’s so important for you spend a few minutes really thinking about what insurance coverage you need. Don’t worry, we’re here to help.

For starters, let’s talk about limits. Most states have minimum liability limits that you’re legally required to carry. However, these minimum limits are typically not enough to protect your family should you get into a serious accident, because if you are at fault, you are responsible for paying for any damages that exceed your coverage amounts. That’s why it often makes sense to carry limits significantly above the minimum requirements, because they go so much further in protecting you when you really need it.

We’ve got some great resources to help you understand car insurance better:

- Learn more about your car insurance coverages here

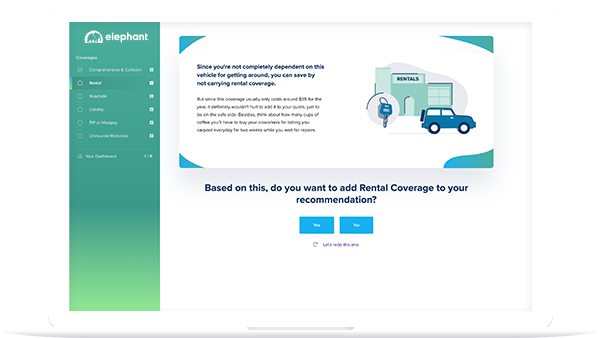

- Use our Coverage Wizard to see which ones you should (or shouldn’t) carry on your auto policy

How much insurance coverage do I need?

State laws require that you carry a minimum level of auto insurance coverage. However, with car insurance, the more coverage you have, the less it will cost you out of pocket if you get in an accident.

Your individual needs and situation will contribute to how much insurance you need. When you’re determining how much insurance to buy, here are a few factors to think about:

What type of car do you drive?

Is your car brand new? You may want to increase your auto insurance coverage to protect your investment in the event you’re involved in an accident. Do you drive a large car, truck, or SUV? Sometimes it’s smart to have higher limits because these vehicles generally generate more damage in accidents.

Do you finance or lease your car?

If you make payments on your car, you may be required to have Comprehensive and Collision coverage in addition to Liability coverage.

Where do you live?

Do you live in a big city where fender benders are a common occurrence, or out in the country where you could hit a deer? If so, you make want to think about increasing your coverage to protect yourself from these common occurrences.

How much can you afford to pay out of pocket?

Choose a deductible that you know you can easily pay out of pocket if you were to get into an accident. Also think about higher limits so that you don’t have to pay for it yourself if damages exceed your limits.

If you are involved in an accident, especially a serious one, the last thing you want to worry about is how you are going to pay for everything. Typically, more coverage only costs a few dollars more per month and you’ll thank yourself for investing those dollars if you’re ever in a serious accident.

If you have any questions about coverage, please call our licensed representatives at 1-855-ELEPHANT.

Interested in learning more about what coverages you need on your policy?

Check out our Coverage Wizard!

Getting a Quote

How long does it take to get my insurance quote?

Elephant makes it easy to get a quick quote. With our online quote process we ask only the most important questions to be able to give you an accurate quote in about 10 minutes. Best of all, you can do it from the comfort of your own home. If you have your current insurance declarations page handy, this will help speed you through the process.

If you decide to buy online, it takes only minutes to set up your auto insurance policy and print your insurance cards. In addition to saving you time, with Elephant you save money when you buy online. Since there is no middle-man, Elephant passes those savings on to you in the form of lower insurance rates.

Does it cost anything to get an online auto insurance quote?

No! Quotes from Elephant are always free, whether online or using our toll-free call center. And you’re not under any obligation to buy an auto insurance policy from us. We want to make the process as hassle free as possible while ensuring you all the savings you deserve.

What information will I need to provide to get my quote?

At Elephant, we’ll only ask you for the information we need to get the right quote for you. We collect basic information about you, other licensed drivers in your household, and the car(s) you’d like covered.

If you have your current insurance declarations page handy, this will help you in determining the coverage levels you want to purchase. Not sure what levels of coverage you need? Give us a call at 1-855-ELEPHANT and our knowledgeable, licensed insurance experts will be happy to help!

What types of auto insurance discounts can I get?

Want to save even more? We know that every dollar counts these days so we’ve created tons of discounts to help you save money on auto insurance. You can earn discounts for being a responsible driver, insuring multiple cars, paying your policy in full, and many other things. Read more about all of the discounts we offer at Elephant.

Why do you ask for email address?

At Elephant, your privacy is important to us and we make sure your personal information is protected. We ask for your email address to make the quote process more convenient for you. When you get an online auto insurance quote we’ll send you a copy of your quote for your records. Your email also serves as your login name for easy access when you return to review your saved quote.

Can I buy auto insurance over the phone from Elephant Insurance?

Elephant strives to make it as fast and easy as possible for you to purchase auto insurance. We realize that when you are making such an important purchase as car insurance, you sometimes want to talk to a person and get all of your questions answered. That’s why when you buy auto insurance from Elephant, you have the option of buying your policy online or over the phone at 1-855-ELEPHANT. Give us a call now, we’re all ears!

Managing Your Policy

Elephant customers are able to easily manage their policy and claims online.

How do I register?

Registration can be done completely online.

You will need the following information to create your account:

- Your Elephant Insurance policy number

- The Primary Policy Holder’s last name

- The Primary Policy Holder’s birth date

- Your email address

How do I access my account?

If you already registered, you’ll just need the email address and password you used when creating your account. Log in.

Forgot your password? Reset your password.

Don’t have an account yet? Sign up.

What can I do online?

- View your policy information

- Print your ID cards and policy documents

- File and track your claims

- Pay your bills with a credit card, debit card, or bank account

- View your bills and payment history

- Set up automatic payments

Can I add or remove coverages in the middle of my policy?

Yes. You can easily add or remove coverages in your online account at any time. Here you can add or remove vehicles and drivers, change your addresses, bill payments, and more. Keep in mind that some changes will affect your rate, so your premium may change.

Have additional questions about managing your account?

Login to view our full list of FAQs.

When and how can I change my car insurance policy?

At any time! Making changes to your policy is simple. You can login to your account to make most changes to your policy.

- Change your coverage

- Add or remove vehicles

- Update your payment or contact information

How quickly do changes I make go into effect?

If you make a change to your policy, the change will be effective within 24 hours from the date that you select.

How do I add or change a driver or vehicle?

You can update your vehicles or add drivers to your policy at any time by accessing your policy online. If you would like to remove a driver, please call us at 1-855-ELEPHANT.

How do I change my payment date or method?

You can change your payment method or date at any time by logging into your account.

How do I renew my policy?

Great news, you don’t have to do anything! Your policy will automatically renew. We’ll send your updated renewal documents and billing information prior to your renewal date.

Elephant will always send you a reminder before we withdraw payment from your account. If you want to change your payment method before your policy renews, you can update it online.

Claims

What should I do if I’ve been involved in an accident?

- Stay calm

- Move your vehicle out of the way of traffic and turn on your hazard warning lights

- Get medical help if anyone is injured

- Phone the police even if the accident is minor

- Discuss the accident with the police only

- Do not admit fault to anyone

- Gather information. Get the names, addresses, phone numbers, and auto insurance information of all parties involved. Be sure to get contact information from witnesses

- If you have a camera with you, take photos to document vehicle damage, the accident scene, skid marks, and any other features of the accident scene

- Report the incident to Elephant Insurance as soon as possible by using our online form

- Take reasonable steps to protect your vehicle from further damage

How do I file a claim?

There are two ways to file a claim:

- You can file a claim online 24-7 using our online form

- You can give us a call during our business hours by dialing 844-937-5353

When reporting an auto insurance claim, please have the following information handy:

- The date and location of the incident

- Your Elephant Insurance policy number

- The other party’s insurance information and phone number

- A general description of what happened

- The name of the police department involved and the police report number

How do I report a windshield or glass claim?

Elephant has designed an Express Glass Service to help you immediately resolve any windshield or glass-only claims.

Simply call 1-800-413-8860 to report a windshield or glass only claim. A trained claims specialist will schedule an appointment to have the damages either repaired or replaced.

Many windshield claims can be repaired. If you have the applicable coverage, and the damage to your windshield can be repaired, Elephant will not charge you your deductible.

You have the choice as to which glass repair shop does the work on your vehicle. If you do not have a repair facility in mind, Elephant has created a network of glass repair shops to assist you in getting your car repaired as quickly as possible.

Will filing a claim affect my premium?

During the 6 months your policy is in force, your rate will not increase due to any claims filed. When your policy is up for renewal, we will assess your current rating factors and let you know what your new rate will be prior to the renewal date. Your rate may go up or down, depending on the many factors we use to calculate your premium.

Some of these factors include:

- Discount eligibility

- Your driving record

- The number of claims you have made in the past three years

- The number of “at fault” claims you have made in the past three years

- The extent of any damages which were covered

We know that getting into an accident is stressful, but we’ll make sure to get started on your claim as soon as it’s filed.

We aim to have a transparent and easy claims process for our customers. If you ever have questions about the status of your claim, you can call your adjuster directly, or speak to one of our claims representatives by calling 844-937-5353.

How does the Elephant claims process work?

We understand the stress and inconvenience of having to file a claim. Our team process is designed to be hassle-free so that you can get back to your normal routine as soon as possible.

You should first report all claims as soon as possible to Elephant by using the online claims service or by calling 844-937-5353. A claims representative will collect the necessary information needed to get the claim started. This process should take approximately 15-20 minutes.

Next, a claims specialist qualified to handle your specific needs will be assigned to your claim so they can get started right away at processing it.

Some of the steps your claims specialist will commonly follow to make sure we get all the facts about the incident include:

- Review your insurance policy and the coverage in effect to determine what types of damage or injuries are covered

- Attempt to speak with everyone involved in the incident – drivers, passengers, witnesses – to get everyone’s account of the incident

- Conduct a detailed interview with each person involved if there are conflicting versions of what happened in the incident

- Gathers and reviews other relevant information such as the police report, applicable state and local traffic laws, photos of the scene and the vehicles involved and other available information

If your vehicle is damaged, your claim specialist will assist you in the repair process, including offering you a qualified shop in our Approved Repair Service if you do not already have a repair shop in mind. Your claim specialist will be with you every step of the way to explain the process and answer any questions you may have.

How quickly will my claim be processed?

Since every claim situation is unique, the time needed to process a car insurance claim can often vary. A more complex claim can sometimes require more time, but a simple claim can often be resolved in just a few short days.

Our claims team will make sure to keep you in the loop every step of the way, so you aren’t unsure about the status of your claim at any time.

Will Elephant pay for a rental car after I file my claim?

Just because your car is in the shop doesn’t mean your life should be put on hold. Unfortunately, depending on what type of claim you filed, you might be without your car for some time. If your policy has Rental Car Reimbursement Coverage on it, you’ll have access to a rental car if you need one.

Make sure to check with your claims adjuster to see what type of rental car you’ll have access to and for how long since it’ll depend on what type of rental coverage you purchased on your policy.

We aim to have a transparent and easy claims process for our customers. If you ever have questions about the status of your claim, you can call your adjuster directly, or speak to one of our claims representatives by calling 844-937-5353.

What are my options for getting my damaged vehicle repaired?

After you file the claim, your car’s damage must be reviewed before it can be repaired. Here are your options:

Elephant Approved Repair Service (EARS)

Choose one of our pre-qualified shops for 100% guaranteed repairs for as long as you own your car.

Photo Estimates

Use our easy to use photo app to send us photos of the damage and get an estimate.

Repair Facility of Your Choice

Elephant will work with your repair facility of choice to help get you back on the road as soon as possible.

Elephant Approved Repair Service (EARS)

To make your claims experience as satisfying and hassle-free as possible, Elephant has created an Approved Repair Service. This is offered as a free option to those customers who have not chosen a repair shop or do not know where they want their vehicle repaired. The repair facilities in this program have been pre-qualified to ensure they have state-of-the-art equipment and that their repair quality and standards are exceptional.

Using this service brings the following benefits:

- Convenient locations nationwide

- Exceptional customer service

- Continuous status updates while your vehicle is being repaired

- Quality repairs that are done quickly

- Limited Lifetime Guarantee

Photo Estimates

If your car is drivable, you can use our easy to use photo app to send us photos of the damage and get an estimate.

Repair Facility of Your Choice

The choice of who repairs your vehicle is always up to you. Elephant will work with your repair facility of choice to help get you back on the road as soon as possible.

*Elephant only guarantees the work of our in-network shops. You can discuss with your shop of choice if any guarantee applied to their work.

*Please note that Elephant Insurance cannot be responsible for unnecessary delays caused by any repair facility that you choose that is not a part of our Approved Repair Program.

What is the repair process if my vehicle is drivable?

- Provide a copy of your repair estimate to the repair shop.

- Your repair facility should order all needed parts prior to scheduling your vehicle for repairs. Once this is done, your repairs should be scheduled for a Monday once all needed parts are at the shop.

- Failing to follow the above process could result in out of pocket expenses for you.

What is the repair process if my vehicle is non-drivable?

- You should make every attempt and work with Elephant Insurance to ensure your vehicle is not sitting at a facility that is charging a daily storage rate. If you fail to do so, you will be notified, in writing, via our Move and Mitigate letter and could incur substantial out of pocket expenses as a result.

- A copy of your Elephant Insurance estimate to repair must be provided to your repair facility.

- Your repair facility should order all needed parts as soon as possible. Once this is done, your repairs should be scheduled as soon as possible based on when all needed parts will be at the shop.

- Failing to follow the above process could result in out of pocket expenses for you

What if more damage is found after the facility starts repairs?

A vehicle involved in an accident can sometimes have damage that is not visible at first. Any adjustments made to the initial estimate are called “supplements.”

If additional damage is found while repairing your vehicle, the repair facility will contact Elephant to complete a supplemental estimate. From there, your Elephant claims adjuster will keep in contact with you to let you know what the next steps are.

If I have Rental Reimbursement on my policy, how long will I have a rental?

- The policy limit for Rental Reimbursement, if you elect this coverage, is the maximum Elephant Insurance could pay for any singular incident.

- About 4 hours of repair work per day is fairly common in the collision repair industry. So, if your repair estimate includes a total of 16 labor hours, then repairs to your vehicle should be completed in no more than 4 days.

- Additional repair (and rental) days may be warranted if your vehicle is non-drivable. These may include, but are not limited to, days for the vehicle to be inspected, parts to be ordered at the repair facility and if additional damages are found once the repairs are underway.

What kind of parts will be used to repair my vehicle?

- Depending on the age and mileage of your vehicle, as well as parts availability, Elephant Insurance may use OEM, Optional OEM, Recycled, Reconditioned, Remanufactured and Aftermarket parts to restore your vehicle to its pre-loss condition.

- You and your repair facility should be aware of this upfront.

- If an alternative part chosen by Elephant Insurance fails to adequately repair your vehicle, then we will gladly revisit this as long as the issue is well documented on the shop’s end.

What if there is a discrepancy in what the repair facility is charging and what Elephant is paying?

Every appraisal resource used by Elephant Insurance attempts to reach agreed prices with all repair facilities based on what is fair and reasonable within a specific geographic area. In most cases, any discrepancies in cost are resolved and this is a non-issue. However, there may be times where what your shop of choice (non-Elephant Approved Repair Program) is charging does not align with what is fair and reasonable for the area and applicable repairs to your vehicle. In these cases, you will be notified, in writing, via our Reasonable and Customary letter. We will make every attempt to prevent this, but you may encounter some out of pocket expense if we cannot reach an amicable repair cost with your shop of choice.

What makes a vehicle a Total Loss?

Financial: The cost of repairs, rental, salvage value and other considerations are close to or exceed the value of the vehicle.

Safety: While the cost of repairs may not exceed the value of the vehicle, will the vehicle be restored to pre-accident condition?

State Regulations: Every state has regulations which indicate a threshold at which an insurance company must deem a vehicle a total loss.

What are the steps in the Total Loss process?

- Typically Elephant will obtain your total loss vehicle. It will be moved to our storage facility for safe, secure, and fee free storage until the claim is paid. If you plan to retain your total loss, this step can be skipped.

- Elephant will need documents (title, power of attorney form properly completed and signed by the appropriate owner/owners, other miscellaneous documents) from you.

- Elephant will contact your loan provider (if applicable) for a Letter of Guarantee. Most lienholders take 1-4 weeks to send us this document.

Will my total loss settlement pay off my loan?

Possibly. The total loss settlement is the value of your vehicle plus any applicable taxes, less any applicable deductions. GAP coverage will help with situations where your loan balance is higher than the value of your vehicle. Contact your financial institution to see if you have that coverage.

If you purchased Loan Lease Payoff Coverage with us:

Your total loss adjuster will need to obtain your payment history of the loan, a copy of the bill of sale, and financial agreement from when you purchased the vehicle. In most states, there is a 25% cap on loan lease (this is 25% of the adjusted actual cash value from your total loss settlement).

There are several exclusions that aren’t covered by your loan lease coverage:

- Your deductible

- Damage not related to the loss

- Excessive milage deduction

- Coast of Service Contacts or warranties

- GAP coverage purchased from the dealership or your lienholder

- Late fees, missed payments, payment holidays, etc.

Will I be able to retain my total loss?

Possibly. First, we must consider your state’s laws, as some states will not allow you to keep a total loss vehicle.

Do you have a lien? If yes, then you will need to speak with your loan provider to see if they will allow you to retain the total loss.

How is the value of my vehicle determined?

Elephant uses a market evaluation, considering factors such as year, make, model, mileage, overall condition and major options. Your vehicle is also compared to vehicles that have sold or are for sale in your local market. Based on those findings, the value of your vehicle will be determined.

Now that my vehicle is a total loss, how long will I have my rental vehicle?

As a customer, your policy provides you 3 additional days once you are contacted and a settlement amount is communicated.

If payment is applicable, we have the following options:

- In most cases, we recommend you let us pay the repair shop directly. We’ll pay the shop the entire cost except for your policy deductible, which you are responsible for paying to the shop.

- We can also send payment to your bank account or by mail. In some instances, we will need to pay payments to you and your lienholder.

*Any payments made are subject to the terms and conditions of your policy.